Division 7A Unsecured Loans Accountants Desktop

Division 7A Loan Agreement Pack RP Emery Shop

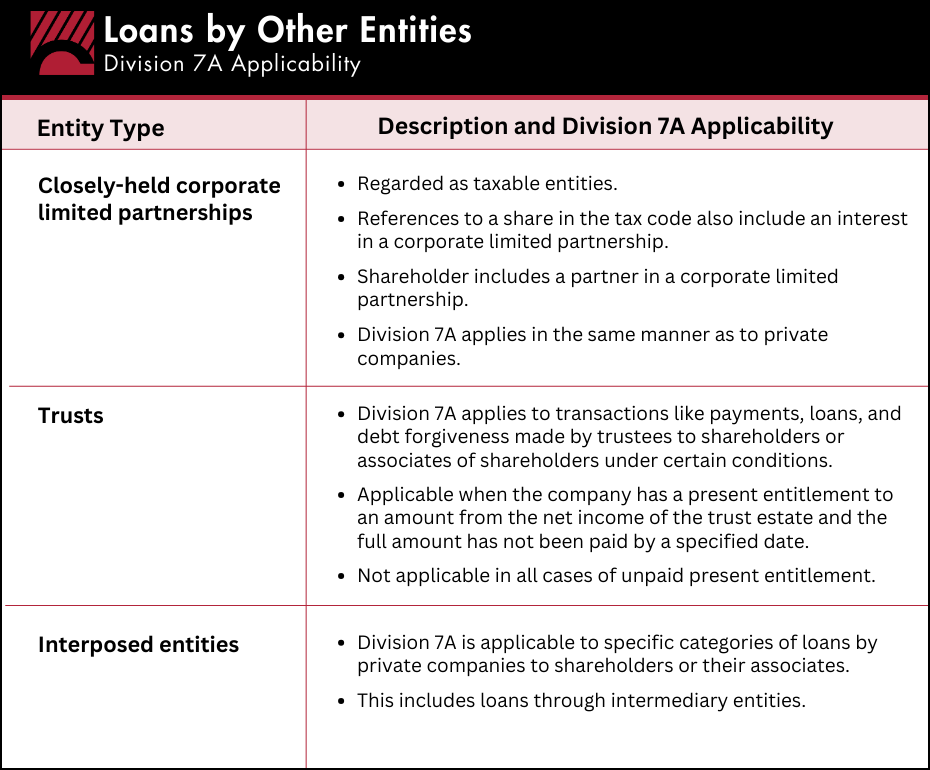

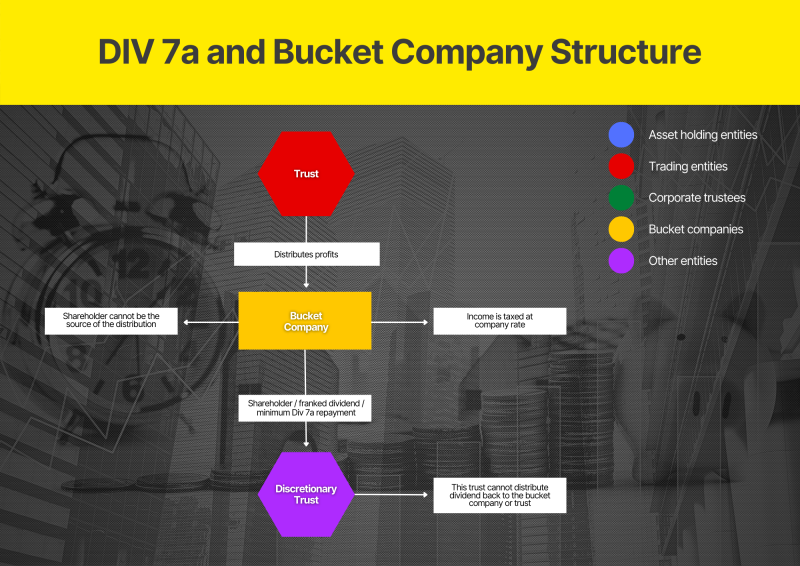

A loan to a trust can be subject to Division 7A. Division 7A applies where there is a loan, payment or the forgiveness of a loan to a shareholder or an associate of a shareholder of a private company. In most cases, practitioners readily identify and correctly deal with Division 7A loans to individuals. However, the definition of an.

Division 7A company loan agreement template

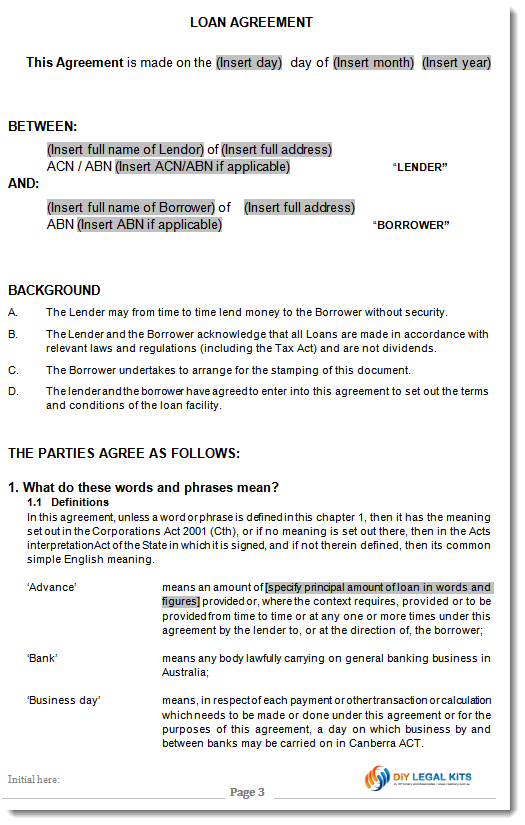

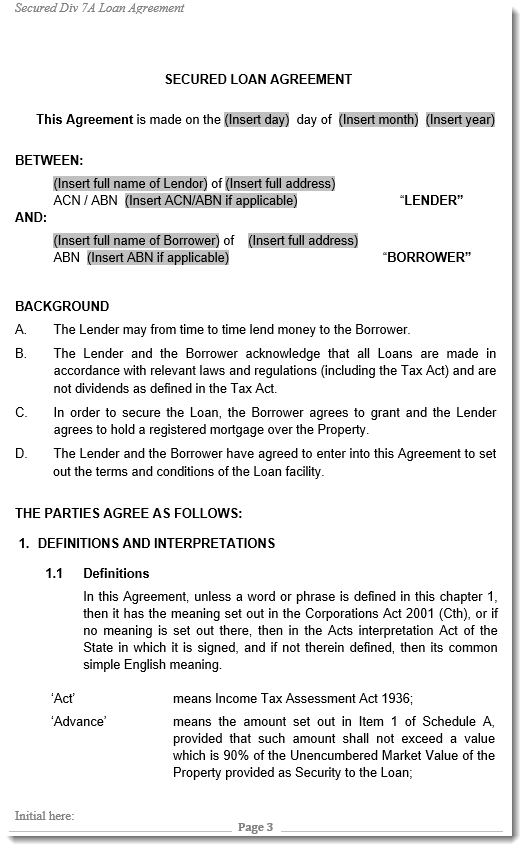

A Division 7A loan agreement provides a method for loans from a company to be treated as loans, rather than distributions of income. In effect, it ensures these distributions are able to be treated like dividends, and not as assessable income for tax purposes. This covers things like: loans and forgiven loans.

Division 7a Loan Agreement Template Free Download LegalVision

The recent increase in the benchmark interest rates for 2023-24 has significant implications for small business owners and company directors who have received money under Division 7A terms. The benchmark rate for 2022-23 was 4.77%; for 2023-24, it is 8.27%, an increase of over 73%. This increase will affect the minimum annual repayment of.

Division 7a Loan Agreement Unsecured RP Emery Shop

Division 7A of the Income Tax Assessment Act 1936 (Cth) (ITAA36) is a self-executing set of integrity measures designed to combat the extraction of profits from private companies in a non-taxable form. Such profits have usually only borne 30 cents in the dollar of company tax — far lower than the top personal tax rate of 46.5 cents that the.

Division 7A, Div7a company loan agreement template

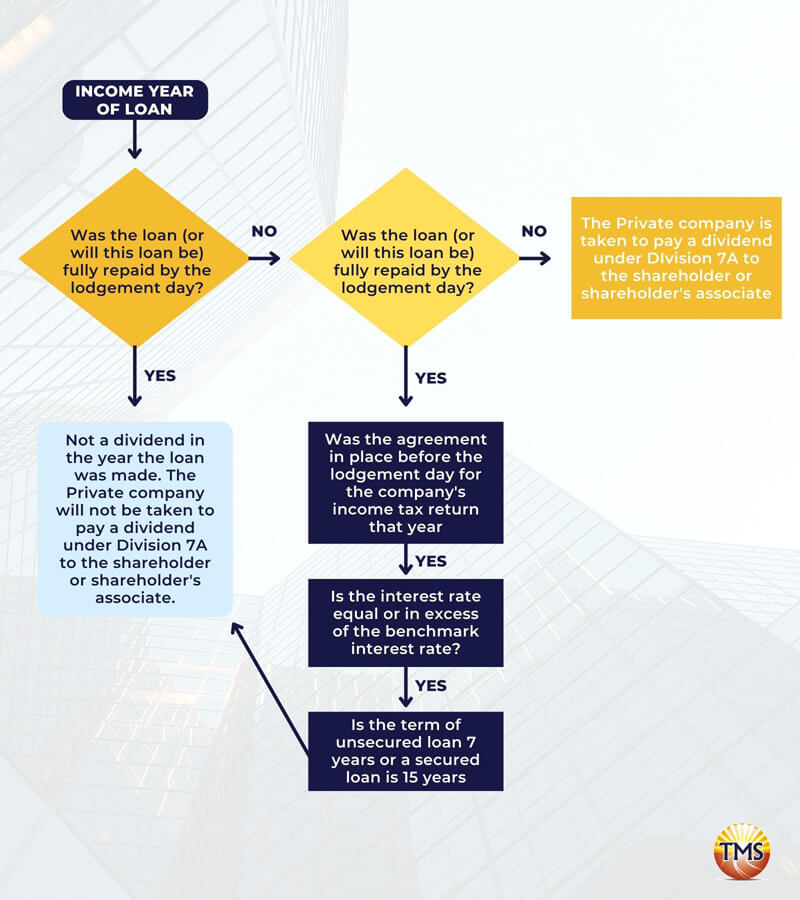

Division 7A deems the amount of any loan, advance or payment outstanding at the end of a financial year to be an unfranked dividend unless certain requirements are met. This effectively means that the whole amount of any loan or payment will be taxable to the shareholder without franking credits being available.

ATO's 4 problems with Div 7A Loan deed. Build on law firm website

Division 7A aims to prevent shareholders from extracting profits or assets from their company tax-free. When a private company loans money to a shareholder or associate in a given year, Division 7A can consider it as a dividend payment by the company. This dividend is then taxable for the shareholder or associate.

Understanding Div 7A Loan Causbrooks

The Cleardocs Division 7A Loan Agreement can be used when a company makes a loan: to a shareholder or shareholders of the company; or. to an associate of a shareholder of the company — the term 'associate' has the same meaning as in Division 7A of the Income Tax Assessment Act 1936 (Cth). 5 minutes. The master documents are written in plain.

How Does Division 7A loan work YouTube

The Division 7A calculator and decision tool has 2 components to help you determine the effect of Division 7A in relation to payments, loans or debt forgiveness from private companies and how to meet your obligations on complying loans. To learn more about: the operation of Division 7A, visit Private company benefits - Division 7A dividends

What is a Div 7A Loan? Walsh Accountants

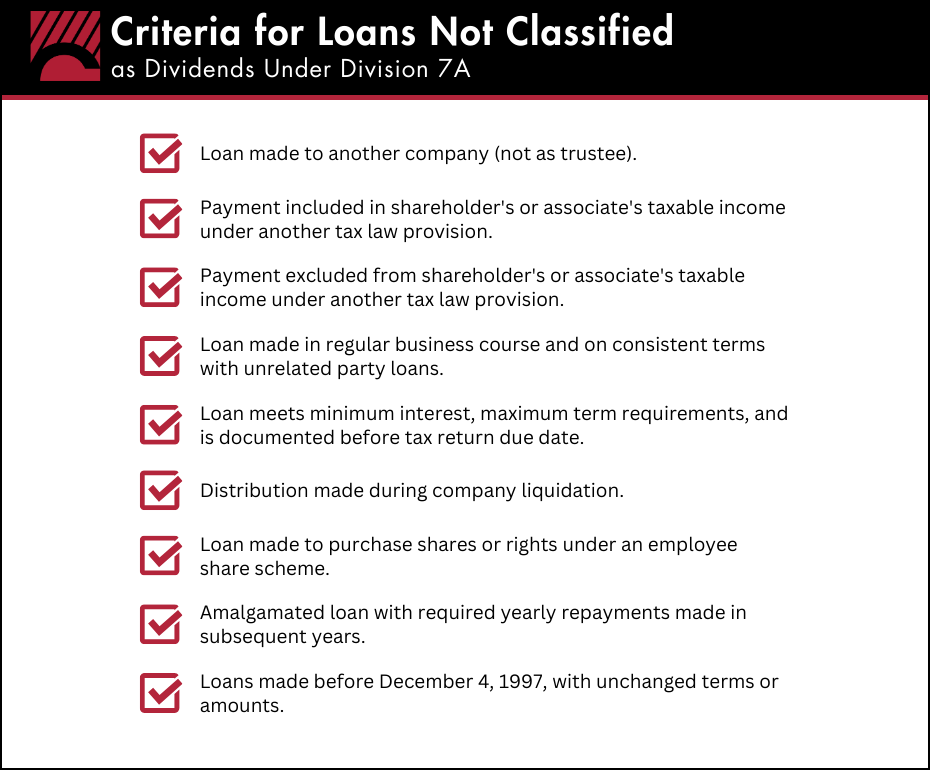

Division 7A is a provision that requires private companies to fulfil certain criteria when making transactions to avoid tax liability. It applies to all loans, advances and other credits made by private companies to shareholders or their associates. In this way, it aims to prevent private companies from distributing profit tax-free.

How To Avoid Division 7A Penalties TMS Financial

Division 7A defines a loan as: an advance of money. a provision of credit or any other form of financial accommodation. a payment of an amount for, on account of, on behalf of or at the request of, an entity, if there is an express or implied obligation to repay the amount. a transaction (whatever its terms or form) which in substance is a loan.

Essential what you need to know about division 7A loan agreement loan Business Kitz Australia

7 (a) Small. 7 (a) Small loans are term (non-revolving) 7 (a) loans that are $500,000 or less and may be processed under Preferred Lender Program (PLP) delegated authority or non-delegated through the LGPC. 7 (a) Small loans exclude: Standard 7 (a) loans, SBA Express, Export Express, CAPLines, Export Working Capital Program (EWCP), and Pilot.

Company Debit Loan (Division 7A) Smart Workpapers Help & Support

Types of 7 (a) loans. The 7 (a) loan program is SBA's primary program for providing financial assistance to small businesses. The terms and conditions, like the guaranty percentage and loan amount, may vary by the type of loan. Learn about the types of 7 (a) loans.

Understanding Div 7A Loan Causbrooks

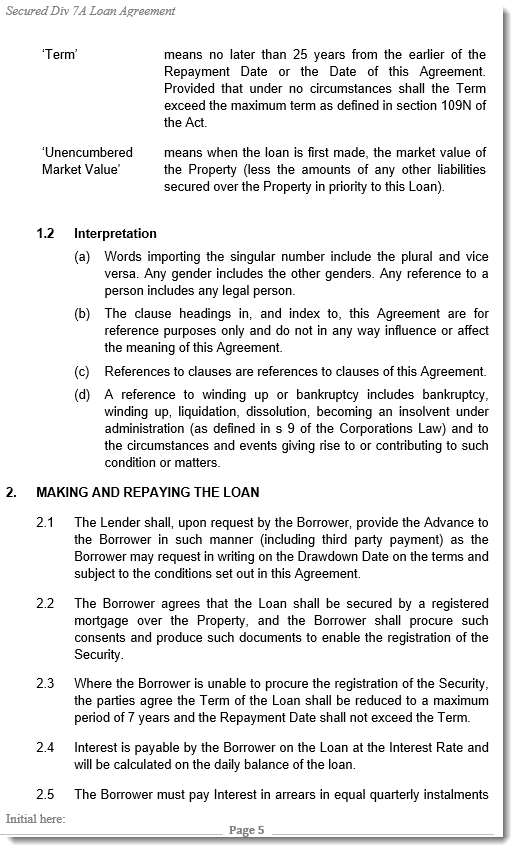

Division 7A applies to certain payments, loans and debt forgiveness made by trustees to a shareholder or an associate of a shareholder of a private company, where: the company is presently entitled to an amount from the net income of the trust estate. the whole of that amount has not been paid by a specified date.

Division 7A company loan agreement template

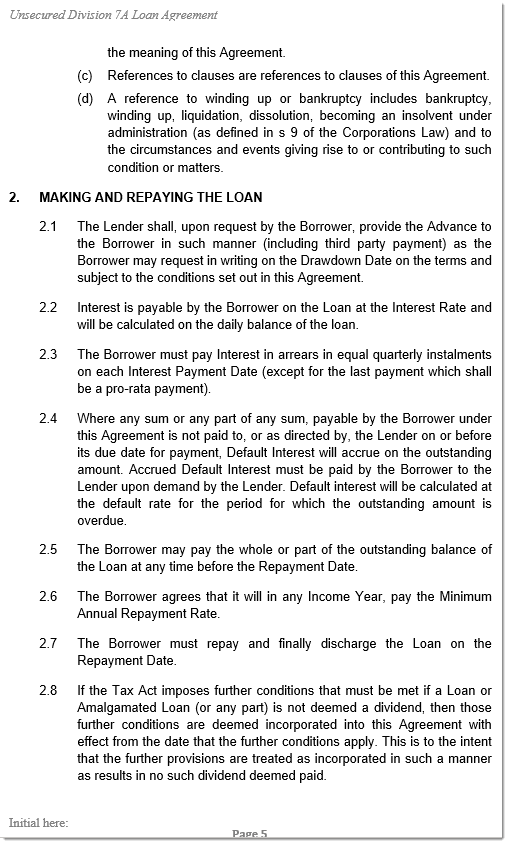

The Div 7A loan terms are generally 7 years, although a secured loan can be 25 years. The loan is usually paid by declaring a dividend equal to the required minimum repayment (each financial year) so there is no actual repayment of cash to the company. The loans are 7 year principal and interest terms. The interest rate is the benchmark rate as.

Division 7A loan agreement Cleardocs ntaa com Doc Template pdfFiller

Division 7A is part of the Australian Income Tax Assessment Act 1936 that applies to certain payments, loans and debt forgiveness to prevent private companies from giving tax-free profits to shareholders. If the loan does not meet the Division 7A requirements, it could be treated as an unfranked dividend and be subjected to income tax when.

Dealing with Div 7A loans a different approach Nexia Australia

The 7 (a) Loan Program, SBA's primary business loan program, provides loan guaranties to lenders that allow them to provide financial help for small businesses with special requirements. 7 (a) loans can be used for: Acquiring, refinancing, or improving real estate and buildings. Short- and long-term working capital.